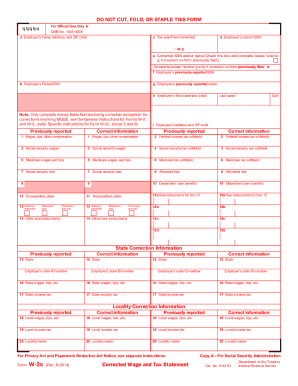

Download 2012 W2 Form Free

Feb 1, 2018 - 0 Comments. Download 2012 W2 Form Free. Ready to file your tax return but can't find your W-2 form? If you realized you lost a prior year W-2,. File:Form W-2, 2006.png Metadata This file contains additional information such as Exif metadata which may have been added by the digital camera, scanner, or software program used to create or digitize it.

Ready to file your tax return but can’t find your W-2 form? If you realized you lost a prior year W-2, there’s still hope. The process to get a copy of a W-2 can be fairly simple. In order to receive a copy of your prior year W-2, you have three options. After requesting the W-2, create an account and start preparing your late tax return on Option #1: Get your W-2 from previous employer.

The easiest way to get a copy of a lost W-2, is to contact the employer who issued it. The payroll department of your employer (or former employer) should be saving important tax information, such as W-2s. Ask for the W-2 to be sent to you. This process is pretty simple and shouldn’t take much time.

Option #2: Get your W-2 from employer’s payroll provider. Have you asked your employer for your W-2 and noticed that he mentally added the task to the very bottom of his To-Do list? If you know that your employer (or past employer) uses a payroll provider instead of calculating payroll in-office, skip the middleman and give the company a call yourself. When you call, be prepared to verify your SSN or employee number as they may ask for it.

While speaking to the payroll provider, you may want to confirm the following: • Specify the year of the W-2 form that you need sent to you. • Verify the address they have on file for you. This is the address they will mail your W-2 to. • Ask how long it will take for them to mail your W-2 form.

Option #3: Get your W-2 from the IRS. For an actual copy of your W-2 form, you will need to file. This gets you a copy of your tax return along with your W-2. If you only need the federal information that was reported on your W-2 (not an actual copy), then you’ll file. This provides you with a transcript of your tax return too.

This alternative may be more time-consuming than reaching out to an employer. However, it requires NO hunting down of past employers to get them to spare a nano-second of their time. What you should know when requesting previous year W-2 forms from the IRS: • The IRS keeps copies of past W-2s (and all tax documents under your Social Security Number) from the last 7-10 years. • The W-2s are not available from the IRS until one year after they were filed. • You will need to fill out Form 4506-T or 4506, sign and mail it to the address listed on the form. • With form 4506, mail full payment with your form to avoid your request from being rejected.

VIP Membership For as little as $4.00 per month you can become a VIP member. We would ask that you whitelist us and allow ads to show. Mod v sims 4 putj k slave owner. This means our main source of income to cover bandwidth costs is blocked when you are using our free service. We have detected that you are using an Ad-blocker plugin. Anyone using an Ad-blocker plugin will be forced to wait 180 seconds instead of 10 on the 'please wait' page.

• It may take up to 75 calendar days for the IRS to process your request. Get started filing your prior year tax return today.

There are several roads available to you for tracking down a copy of your W-2. While contacting your employer is the quickest and cheapest way, the IRS route may be more reliable and less of a burden to you. Once you receive the copy of the W-2, you can then use the information provided and Tags:,,,, This entry was posted on Tuesday, October 18th, 2016 at 12:09 pm and is filed under. You can follow any responses to this entry through the feed. You can, or from your own site.

128 Responses to “How to Get a Copy of Your W-2 Form for Prior Years”. I need a copy of my 2003 tax return, and there is nowhere get it. Searched the IRS Website and registered for a transcript and they only have them back to 2004, in my case. So, the IRS does not have a copy of my 2003 W-2. Arcgis pro crack download.

I met with the State Tax Board and they only have a “Third Party” document (which they refuse to show me), and the NC DOR says it shows the income and no deductions taken out, which is of course completely incorrect and inaccurate. If anyone knows how to get one, please let me know. But, also please do not suggest I go to the IRS Website, or The Social Security Administration, or the State Tax Board. I have been to all, and have exhausted those avenues.